Teen Finance Starts at Home

Summer vacation is right around the corner, which means your teenager may be looking for their first job! This is a crucial milestone in a teen’s life and starts to lay the foundation to become a responsible adult including how to spend and save their money. Providing your teen with a basic understanding of banking as well as setting up healthy money habits can have a large impact on the rest of their financial life. Here are some tips you can provide your teen on how to manage their money wisely.

1) Goal Setting

Some teens may want to spend every paycheck earned while hanging out with friends, and others may want to save for their first car or college fund. Help your teen set realistic goals by establishing timelines and attainable dollar amounts. Don’t be afraid to assign your teen to making small contributions to the household such as paying for gas, new clothes, etc…

2) Budget Planning

Based on your teens’ goals, create a budget that will allow them to achieve their goals and cover any expenses. Give them a budget to start with and allow them to add and subtract categories on how much they can save or spend with each paycheck. Create line-item examples and show them which category the purchase would fall under.

3) Open a Checking Account

Community Bank offers accounts geared towards teens and younger customers. You will be required to open a joint account with your child if they’re younger than 18. Opening a checking account is the start of teaching your teen good banking habits such as checking account balances, avoiding overspending, how to use an ATM, and more.

4) Find a Savings Account

Teach your teen the importance of putting a little money away each paycheck they receive. This will be helpful in the event of a future emergency or big purchase. Depending on your child’s age, Community Bank will find you the right savings account for your teen. Talk to your teen about different ways to save as well as your local branch on savings accounts offered.

5) Introduction to Investing

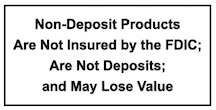

It is never too early to introduce your children to investing in their future. Teach your child about responsible investing and how they can make their money work for them. If your teen has earned income and paying taxes on their wages, they are even eligible to open a Roth IRA. Opening one at a young age will give your teen a jump-start to building personal wealth.

If you’re looking to set your teen up for financial success, visit your local branch for more information.