Safety and Soundness of Community Bank

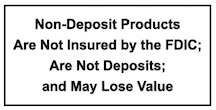

During times like this when the world seems to be turned upside down, bankers receive many questions from customers concerning the strength of the banking industry and the safety of their money. We’d like to address those questions to put your minds at ease. The questions and answers below were provided by the Federal Deposit Insurance Corporation, FDIC.

- Is my money still insured if the bank has closed locations or has limited access to protect the health of their employees and customers?

Yes. Regardless of the bank’s current operating conditions your money is insured by the FDIC . Deposits with an FDIC-insurance bank will continue to be protected up to at least $250,000. - Will there be enough cash during a pandemic?

The Federal Reserve System has and will continue to meet the currency needs of banking customers. Be assured that sufficient resources are available to handle customer needs.Keep in mind, the safest place for your money is inside a bank. Banks will continue to ensure that their customers have access to funds either directly or electronically, and inside an FDIC-insured bank, your funds are protected by the FDIC.

- I have deposits at a bank that I think may exceed the FDIC’s deposit insurance limits. What should I do?

At https://www.fdic.gov/deposit/, the FDIC has a number of deposit insurance resources to help you determine your deposit insurance coverage. A key tool for determining deposit insurance coverage is the Electronic Deposit Insurance Estimator (EDIE), which is available at https://edie.fdic.gov/. In addition, the FDIC website has a wide range of other links that can help you determine your deposit insurance coverage.

Rest assured your money is safe with Community Bank and the banking industry remains strong. If you have any questions regarding your specific situation, please reach out to your friendly staff at your local branch. We are here to serve you!